Description

Why do I need an Employer ID Number (EIN)?

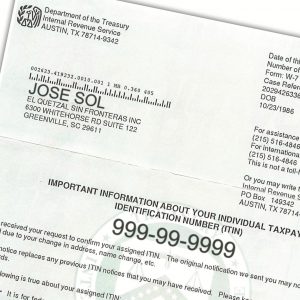

An Employer Identification Number (EIN), also called a Tax ID Number, is a 9-digit code assigned by the IRS to identify your business. You can think it of it as the social security number for your company. An EIN is required for a partnership, corporation, or LLC to open a business bank account, gain financing, hire employees, and more.

Without an EIN, you are forced to combine your business and personal funds which opens you up to increased liability and puts your personal assets at much greater risk. It is highly encouraged that you obtain a federal EIN number and open a separate business bank account so you can keep your business and personal transactions separate.

Benefits of obtaining EIN

An EIN allows the IRS, banks, credit card companies, and other entities to track your business and personal finances separately.

Banks and credit unions require an EIN to open a bank account and it’s also helpful when trying to obtain financing for your business.

You need an EIN to hire employees or offer retirement plans since the IRS uses it for payroll and federal taxes.

An EIN establishes your business as a separate entity, which preserves limited liability should your company ever be sued.

An EIN prevents you from having to give your social security number to suppliers or lenders, which significantly reduces your identity theft risk.

Reviews

There are no reviews yet.