Submit a simple application with details about your business.

Choose a company type and a state.

The first step is to decide in which state you want your business to incorporate in. Next, the legal entity type within that state. There are benefits to each choice and we’ve laid out some information below to help you decide. The most common option is an LLC incorporated in Delaware.

Sign some forms and we take care of everything.

Focus on your business. We’ll handle the details.

Once we receive your application, we start the process by submitting your forms to the relevant state and federal agencies. We’ll follow up with you and track the progress daily to ensure you get your application processed as fast as possible. Depending on how quickly the state agencies process the registration, you should receive your paperwork back in as little as a week.

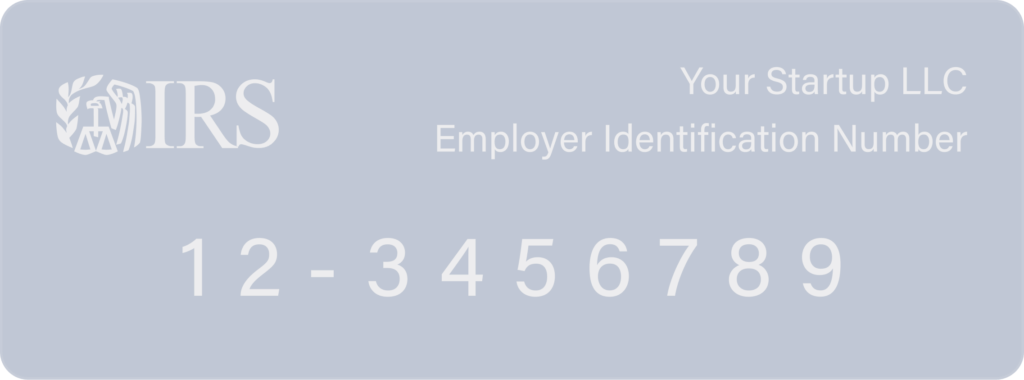

Form 8821.

Signing this form authorizes our dedicated team of EIN specialists to get updates on your EIN status and retrieve your EIN letter.

Form SS-4.

The Application for Employer Identification Number (SS-4) is the IRS form that we use to apply for an EIN for your new company.

Get your bank account for your newly formed company.

Get your EIN and all the legal documents you need.

Get your EIN and all the legal documents you need.

We'll handle the paperwork. We'll help you incorporate a business in the United States

Confidently Start Your U.S. LLC. with us...

Frequently Asked Questions

Apply in minutes and join the greatest startup ecosystem in the world.

No, you don't! We work with entrepreneurs from around the world to get their businesses incorporated. Check out our reviews to hear what people globally say about us.

We will help you form your Company, get your EIN, apply for a bank account, get an address, and set up payment processes.

We don't need any documents to get started. We just need a few pieces of info from you:

- Your Company Name

- Your Personal Address

- Phone Number and Email (For contact purposes)

Later in the process, you'll need a passport to set up your bank account.

A limited liability company is a formal business structure (created as per state law) where the business is legally distinct from the owner(s). It may have a single owner in the case of a Single-Member LLC or multiple owners in the case of a Multi-Member LLC.

An LLC combines the perks of a corporation (protection against personal liability) and a partnership (pass-through taxation). Since the business has a separate legal existence, the members are not personally liable for the debts and obligations of the Company.

State laws stipulate how LLCs should be incorporated. Some states require specific documents, such as the articles of organization, membership agreement, etc., to be filed with the authorities.

Formation takes 3-5 business days, and getting an EIN from the IRS usually takes an additional two to three weeks or so.

The cost varies depending on the State you choose to incorporate in and the services you need from us!

An Employer Identification Number is the tax identification number for your organization and a requirement of many banks or institutions (such as the IRS) to carry out business in the US. Once your EIN is acquired, you can apply for business bank accounts and payment gateways.

An Individual Tax Identification Number (ITIN) can be used as an alternative for a Social Security Number (SSN) in some cases and is not a requirement in most cases. However, you will be required to have one if you wish to apply for a PayPal account or certain bank accounts.

1. We are able to support almost everyone, but unfortunately there are restrictions based on US sanctions and restrictions from our digital banking partners. Therefore, citizens or residents of the following countries are prohibited from forming a company in the US as a result of US government sanctions and restrictions: Cuba, Iran, North Korea, or Syria. Some of our banking partners also have some residency restrictions for the residents of Belarus, Burundi, Central African Republic, Cuba, Democratic Republic of the Congo, Iran, Iraq, Lebanon, Libya, Nicaragua, North Korea, Somalia, South Sudan, Sudan, Syria, Ukraine, Venezuela, Yemen, and Zimbabwe. If you reside in one of these countries, please contact our support with a short description of your company to see if you will be able to get a bank account.

2. Your US business address will be provided by the registered agent. It’s free and included with the package for both Wyoming and Delaware companies.

3. We’ll connect you with expert CPAs and attorneys who will help to set you on the right course and avoid costly mistakes. Our fee includes a set of free consultations on taxes, immigration, and more.

4. In the US business law, a registered agent is a company or individual designated to receive government notices. We work with reputable registered agents based in Delaware and Wyoming to provide you with exceptional service. The first year fee is built into our pricing.

5. We are building a tech-enabled, customer-centric service that combines automation and human touch to scale your overall experience. Firstbase.io provides lifetime support to all of our customers. Our team members will be able to assist you with any of your legal or business needs. Our team members are located around the world and focused on delivering the best customer experience. Our team has successfully helped founders in over 180 countries launch their business.

6. We automatically generate a set of essential legal documents after incorporation. Post-Incorporation documents provide clear and necessary information about company owners, operations, and other vital details about the company once incorporation has been completed. All of the documents will be prepared with standard terms used by top startups. Find more information about each generated document here.